Withholding tax on Foreign services (Hotels case study)

Miscellaneous, Tax

This article provides a general overview of the withholding tax on foreign services in Morocco. Upsilon Consulting offers tax & legal counselling for your specific case. Request a quotation online.

Withholding tax on foreign services…

Turnover: Tax regulations in Morocco

Accounting, Regulations, TaxThe turnover, as defined in article 9 of the General Tax Code, corresponds to the revenues and receivables that the company has definitively obtained as a result of:

Firstly, delivery of goods

Secondly, provision of services

Finally,…

Company Domiciliation in Morocco

Regulations, News, TaxCompany domiciliation in Morocco

First of all, let's define company domiciliation.

Domiciliation is the provision of a legal address to a company without the company itself being located there. This address will only be used for correspondence…

VAT Territoriality : what you should know

Tax, RegulationsWhat are the VAT territoriality guidelines?

The territoriality of VAT refers to the rules that apply to determine whether a transaction is taxable for VAT within the jurisdiction or country where the transaction is performed.

In Morocco,…

VAT credit refund in Morocco

News, Regulations, TaxDid you know? It is possible to obtain a VAT credit refund in Morocco. It is necessary, however, to apply for it and to respect certain rules of substance and form.

Upsilon Consulting gives the key elements of the process.

Read our guide…

Corporate Income Tax in Morocco (C.I.T)

Miscellaneous, TaxCorporate Income Tax : This article provides a brief summary of the provisions of the General Tax Code (C.G.I.) concerning Corporate Income Tax. This summary is not a substitute for a tax consultation or a detailed reading of the provisions…

Deductible expenses – C.I.T. in Morocco

Accounting, TaxThe understanding of deductible expenses is crucial in the determination of the taxable income, subject to Corporate Income Tax (C.I.T.). Indeed, as we explained in our article Corporate Income Tax (C.I.T), the tax base of the C.I.T. is determined…

Foreign Investment in Morocco

Regulations, TaxThe exchange regime for foreign investment in Morocco enables foreign (or non-resident) investors to convert their investments. Indeed, this regime allows non-residents who have invested money in Morocco to recover their investments as well…

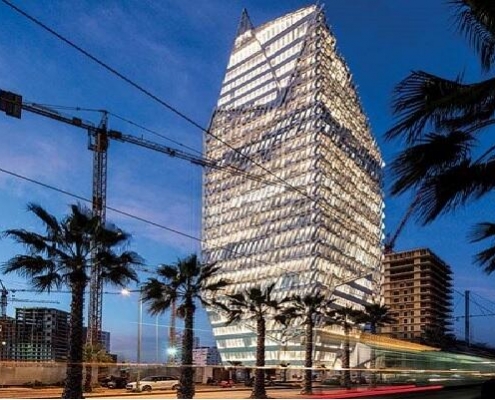

Casablanca Finance City (CFC) : What you should know

News, TaxCasablanca Finance City (CFC) is a Moroccan financial center with a privileged tax status. It sees itself as a financial and economic hub for financial and service activities on the African continent.

Indeed, Casablanca Finance City authority…