Risk mapping: what you need to know

Risk mapping is a generic term used in various management areas. Indeed, this term designates an approach that aims to :

- First, identify risks inherent in an entity’s activities;

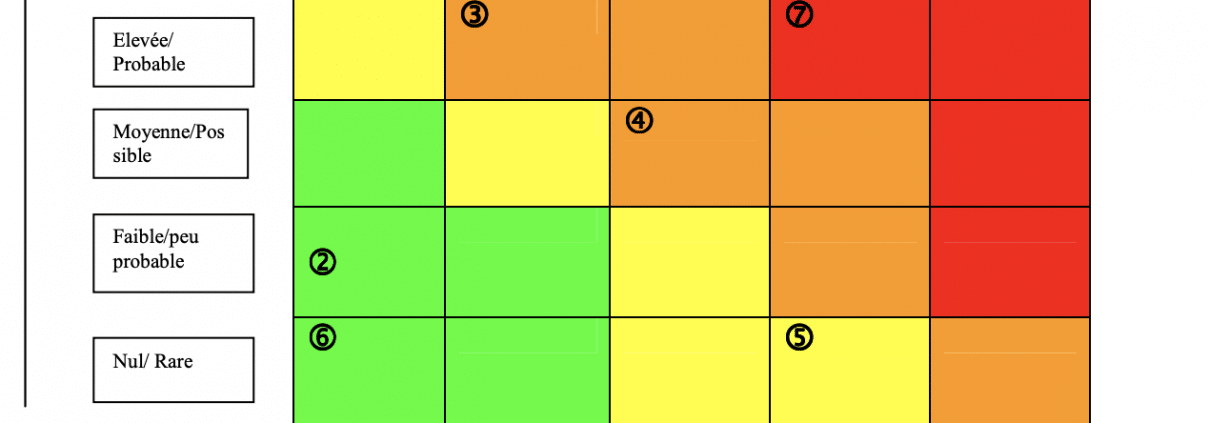

- Second, assess these risks in terms of

- Severity, gravity and impact ;

- Likelihood of occurrence

- Finally, prioritize and the implement management actions

The notion of risk in management

Risk is a fundamental element that influences financial behavior. Indeed, in the absence of risk, the efficient allocation of resources would be remarkably simple. Neither the complex analytical tools nor the wide range of financial tools would be necessary. However, in the world we live in, risk is omnipresent.

First of all, in the financial world, risk management consists in designing a system where the risk is efficiently shared between the different actors. In fact, most (if not all) decisions made by investors factor in risk. In a financial market, it is a matter of maximizing profitability while minimizing risk.

Therefore, a company manager’s mission is to limit the risks to which his company is exposed. The less risk a company has to bear, the more favorable the terms of financing are.

Still, risk is ever present in business. The role of management is to identify, assess and then propose optimal management of said risk.

Why should one conduct a risk mapping ?

Risk mapping is designed to identify risks that may affect the continuity of an activity and its performance. Indeed, managing a company with no knowledge of the risks is akin to driving blindfolded.

As such, it is necessary to:

- First, have the most exhaustive vision possible on the risks that the activity can generate ;

- Second, implement actions to reduce the exposure to these risks and minimize their impact.

Risks to which an activity may be exposed are both several and diverse. As such, risk mapping identifies:

- Legal and regulatory risks ;

- Economic and operational risks

- Financial risks

- Risks relating to human resources

- IT risks

Through a risk mapping, one can have:

- First, a thorough knowledge of the risks;

- Second, an appreciation of their severity and likelihood of occurrence;

- Third, an appropriate plan of action in the event of the risks occurring. One should ask the following questions:

- First, are these risks avoidable?

- Secondly, are these risks bearable? To what extent?

- In addition, can these risks be outsourced? Insured?

- How can one reduce the probability of occurrence of these risks? How can the consequences be mitigated?

- What actions should be taken in the event of occurrence of these risks.

Example: The subscription of a work accident insurance is a consequence of a prior identification of the risk of occurrence of such an accident.

The need for such a risk management policy increases as a company’s activities grow.

Job of a risk manager

The traditional role of the risk manager as business overseer changes as the organization faces an increasingly complex and uncertain future.

The mission of identifying, measuring, managing and controlling risk has become part of the best practices of management.

Today’s risk manager is a key member of the executive team. Indeed, a risk manager:

- First, helps define opportunities from a risk-reward perspective;

- Then, provides unique ways of addressing them;

- In addition, they must be directly involved in the development of products and services and ensure that risks are taken into account.

Example: A company that launches a product that is profitable at first glance, could end up losing the whole opportunity if the risks are not properly managed.

Risk mapping is not only a vital practice but also an evolving one.

Key features of risk mapping

Completeness of risk mapping

By definition, risk mapping must account for the entirety of the company’s process. Indeed, it must cover:

- First, the process relating to the overall environment of management

- Second, operational and technical aspects

- Also, various supporting functions

- Finally, organizational aspects

As such, conducting a risk mapping should involve the different departments of the company.

A written and evolving risk mapping

Risk mapping must be substantiated by writing: a risk map is a concise and organized document. It must also quantify risks by profession, process, sector, etc.

Risk maps are not static documents. They must stay aligned with the evolution of the company’s processes and its environment. Risk maps’ design is built upon an iterative and continuous process.